The following product will be available soon!

TRADE CREDIT INSURANCE FOR EXPORTERS

Grow your exports globally and in your existing markets.

With EXIM Bank of Pakistan’s Credit Insurance program,

if your customer does not pay, EXIM will.

International companies buy an average 40 percent more when they are offered open terms, according to the World Trade Organization. Today, few companies can effectively compete without extending credit to their buyers. EXIM Bank credit insurance products will help exporters to reconsider their payments terms which may be based on advance payments or letter of credits.

Open terms credit facility exposes the exporter to the risk of non-payment of a foreign receivable against non-payment risks due to credit, liquidity or country risk related issues (war civil commotion, transfer restrictions etc.), which in turn makes it difficult for banks to provide required working capital financing.

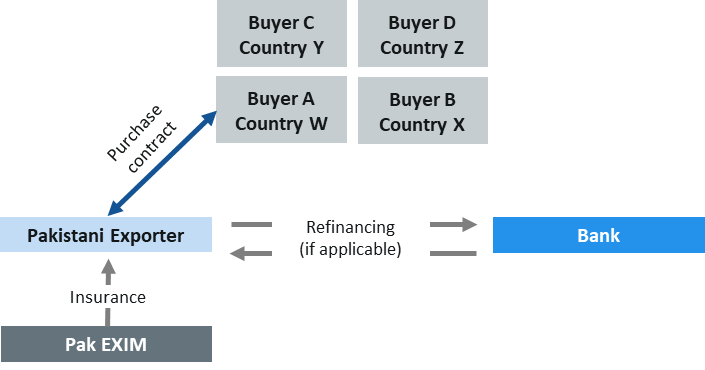

EXIM Bank’s Credit Insurance program brings Pakistan based exporters at the same level playing field as their competitors who are supported by their country EXIMs’ and Export Credit Agencies. With the Credit Insurance Program, many of Pakistan’s exporters will be able to offer open terms when letters of credit or prepayment may have previously been the only safe way to do business. The related policy can then be assigned to a bank as security. In case of a non-payment due to the reasons provided above, EXIM Bank will pay the value of the insured receivable, and therefore protect the balance sheet of the exporter, and by extension, the balance sheet of the banks providing credit to the exporters.

Armed with Credit Insurance, exporters can grow their business in their current markets and explore new markets.

One unpaid invoice can mean the difference between profit and loss, and indeed bankruptcy.

Make Sure Your Invoices Get Paid

Enhances your credit risk management by exploiting our expertise and products. With credit insurance protection, your financial institution will typically lend against your insured invoices for 90% of their value, significantly increasing your access to cash.

Helps you grow your business and expand market presence by facilitating the development of business overseas. Insuring your sales will allow you to offer more attractive payment terms at lower costs to foreign buyers, enabling you to win contracts.

One unpaid invoice can mean the difference between profit and loss, and indeed bankruptcy. With EXIM Bank’s Credit Insurance program, you are protected 85% against non-payment of your Export receivable due to buyer insolvency, contract cancellation, protracted default etc. and 95% due to political events such as war, civil commotion, transferability, and transfer restrictions etc.

How does it work?

Comprehensive Short-Term Policy

CSTP obliges the exporter to insure export receivables to all foreign buyers as verified and agreed by EXIM Bank.

Specific

Transaction Policy

STP enables Pakistani exporters to insure trade receivables arising from a single export transaction.

Bank Master

Policy

BMP protects the insured Bank against the risk of non-payment of intl. receivables from importers.

Documentary Credit Insurance Policy

DCIP protects confirming (exporter) Banks against the risk of non-payment of an issuing (importer) Bank.