The following product will be available soon!

Secure Financing.

We will share the risk with your bank to get you the financing you need.

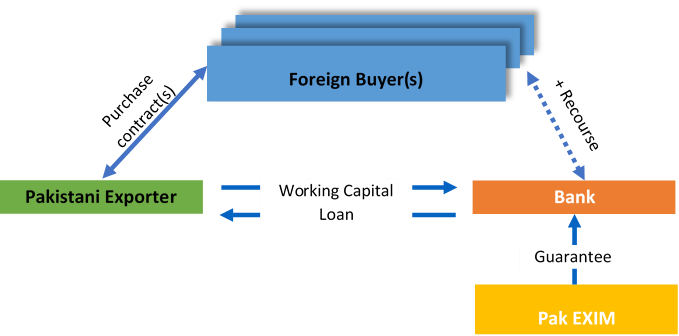

A working capital guarantee ensures the repayment of a loan provided by financial institutions against the credit risks associated with working capital facilities that help finance Pakistani goods and services during the pre-shipment phase. With an EXIM Bank guarantee the commercial bank may be more flexible in its lending criteria.

How does it work?

You would typically provide a collateral for receiving the working capital loan, and the amount the lender will provide is a function of your asset base, which may include trade receivables. With a Pak EXIM guarantee the commercial bank may be more flexible in its lending criteria. guarantee can replace the collateral requirement and acts as a quasi-money security for the beneficiary. The underlying working capital loan may be granted relating to your average export sales turnover or to a single export transaction. Furthermore, banks might profit from capital relief for financing guaranteed by Pak EXIM due to the underlying state guarantee.

IN PRACTICE

We’ve simplified the process

- You receive an export order

You need more liquidity due to receiving more orders, or bigger orders. To manage your cashflow to fulfil these orders you need greater liquidity or credit to finance your day-to-day operations.

- You apply for working capital loan from your bank

As a condition for providing the working capital loan, your bank requires additional security. A guarantee from Pak EXIM can provide that additional security.

- Your bank applies for a working capital loan guarantee

Your bank fills out some paperwork to rate your company, and you sign a declaration. The bank sends both documents to us.

- We assess the application and underlying credit risk

We run a credit rating check on your company.

- We send an offer

If your transaction fulfils our requirements, we inform your Bank about our guarantee decision.

- Your bank will arrange for the working capital financing

Following a positive credit decision, your bank will contact you to arrange working capital financing. Your credit rating and premium are specified in the offer. Repayment of the working capital financing is typically linked to underlying export contract(s) and is typically short-term.

PRODUCT DETAILS

See more details on our Working Capital Guarantee: product description, product mechanism, benefits, eligibility, pricing, credit terms, and risks covered.