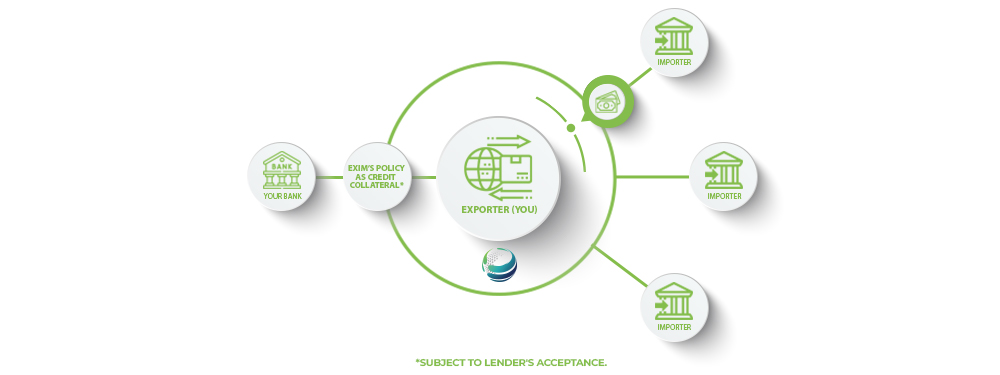

Insure a single export transaction securing your receivables, while offering competitive terms and without the worry of entering new markets.

Secured Business

Insured Transaction

Your business’ targeted protection with EXIM’s ST Policy.

Benefits

Protects Your Balance Sheet

Insures Receivables of a Single Transaction

Protects Your Credit and Open Account Based Export Contract from Default Payments

Can be Utilized as Security Against Working Capital Line from Commercial Banks