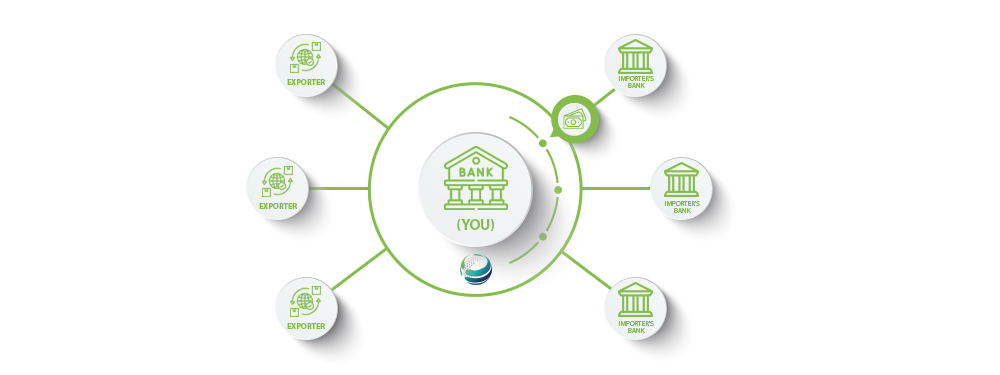

Protects a Confirming Bank against the risk of non-payment by an Issuing Bank, making all markets safe for Pakistani exporters.

Confirming Bank’s

Security Confirmed

Your bank’s targeted protection with EXIM’s DCI Policy.

Benefits

Protects Your Balance Sheet

Protects the Confirming Bank Against Non-Payment by Issuing Bank

Creates Possibilities for Growth by Reducing Risks of Exporting to ‘Difficult’ Markets